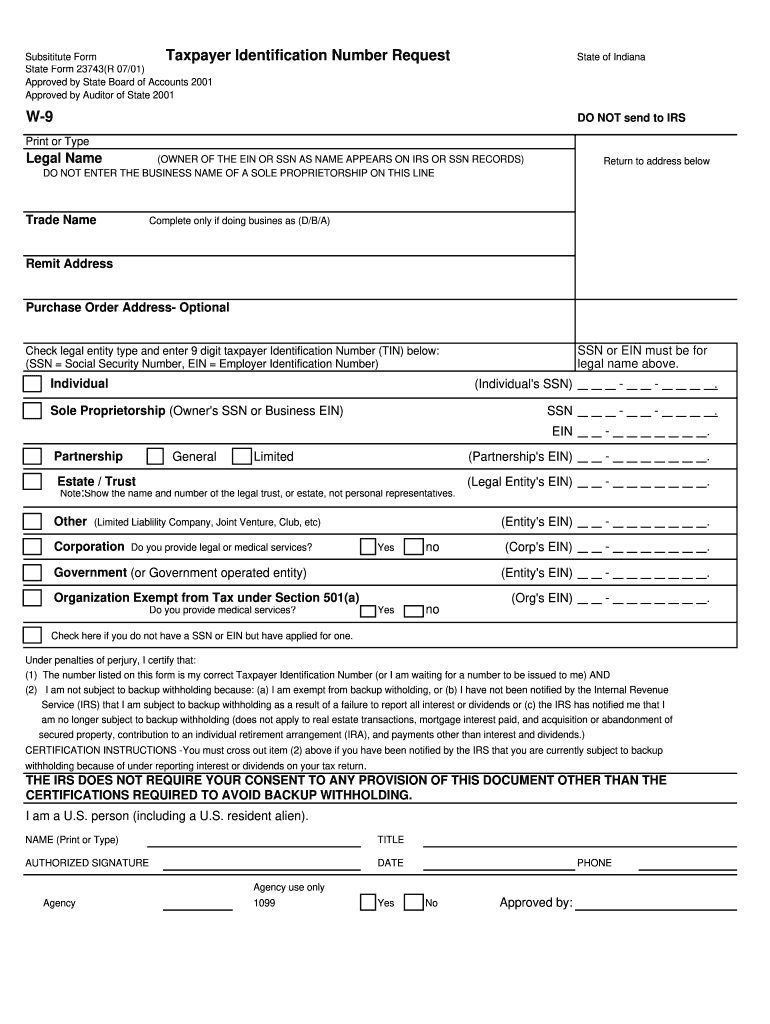

A W-9 form is an official document used by businesses to collect important information from individuals or entities that they plan to pay for services. It is a common practice for employers to require their independent contractors or freelancers to fill out a W-9 form before issuing any payments. The form includes details such as the taxpayer’s name, address, and taxpayer identification number for tax reporting purposes.

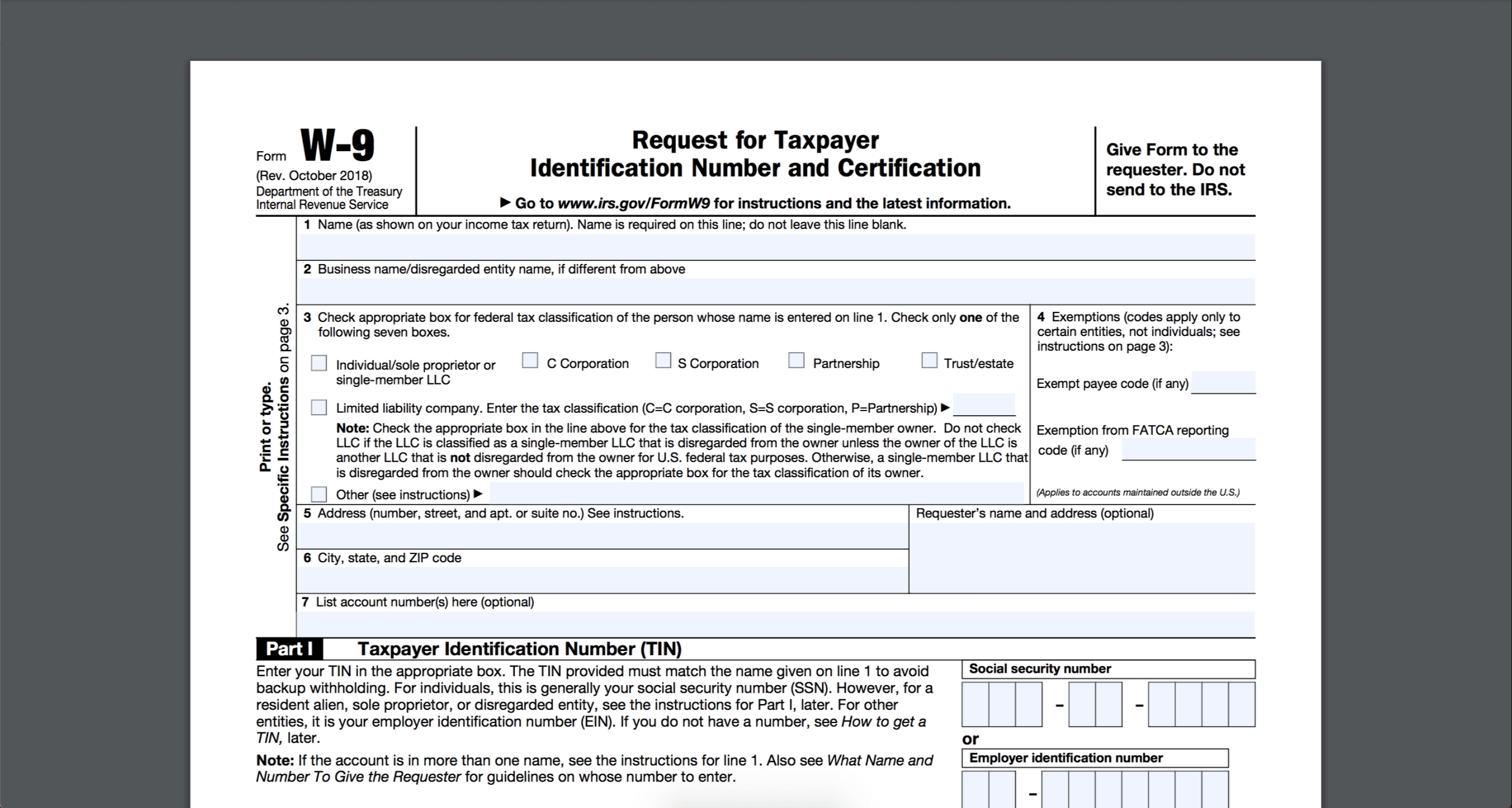

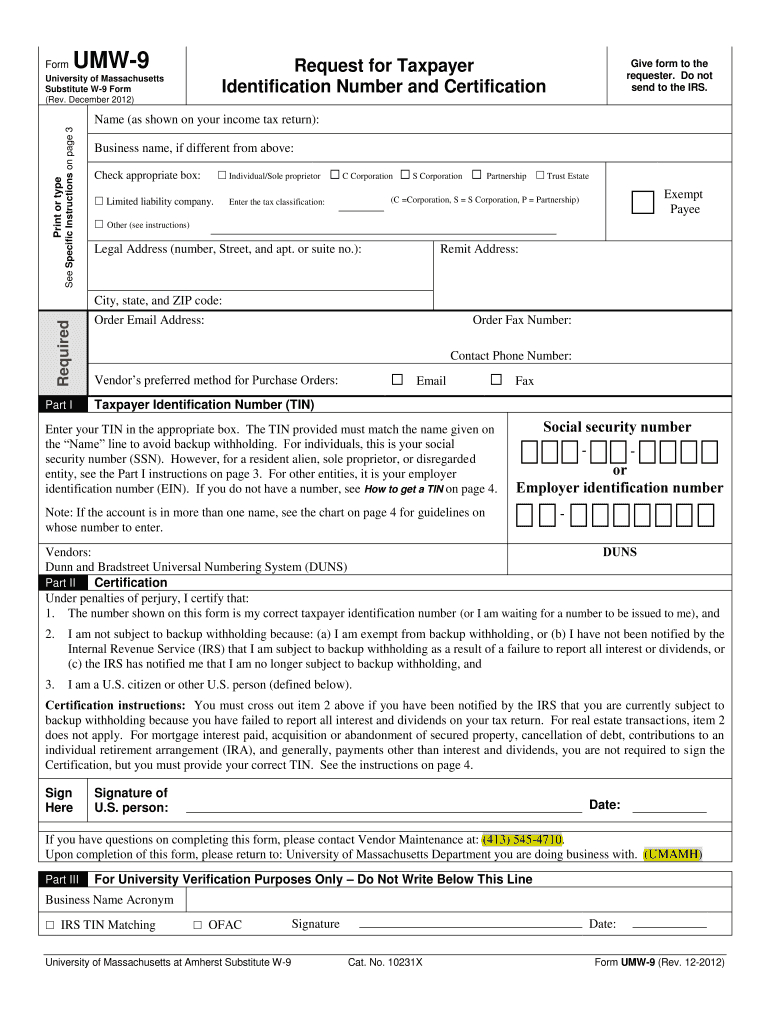

Blank W-9 Form 2021 Printable IRS

One of the popular options for obtaining a blank W-9 form for the year 2021 is through the IRS website. The form can easily be downloaded and printed for filling it out manually. However, it is important to ensure that the form is obtained from a reliable source such as the IRS official website to avoid any counterfeit or outdated versions.

One of the popular options for obtaining a blank W-9 form for the year 2021 is through the IRS website. The form can easily be downloaded and printed for filling it out manually. However, it is important to ensure that the form is obtained from a reliable source such as the IRS official website to avoid any counterfeit or outdated versions.

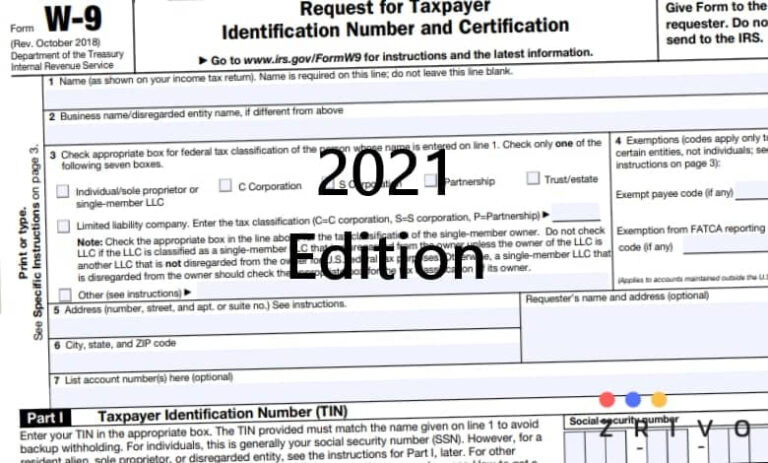

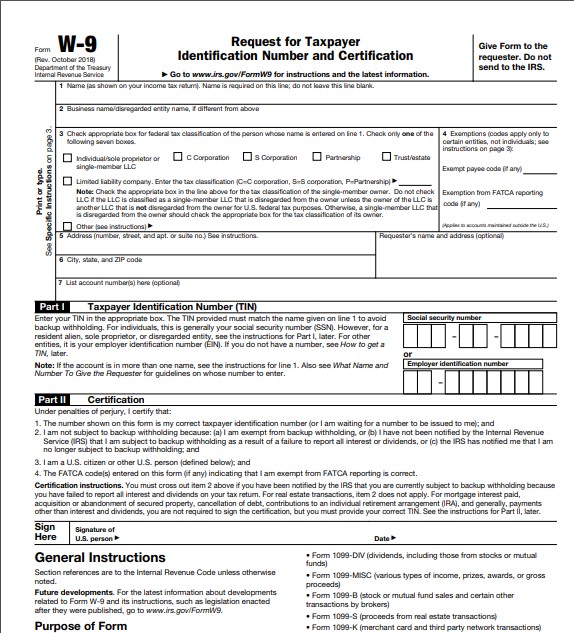

Fillable 2021 W9 Form

For those who prefer a digital option, there are fillable W-9 forms available that allow users to input the required information electronically. This can be a convenient option for individuals who want to avoid the hassle of printing and handwriting the form. Fillable forms generally have editable fields where users can type in the necessary details.

For those who prefer a digital option, there are fillable W-9 forms available that allow users to input the required information electronically. This can be a convenient option for individuals who want to avoid the hassle of printing and handwriting the form. Fillable forms generally have editable fields where users can type in the necessary details.

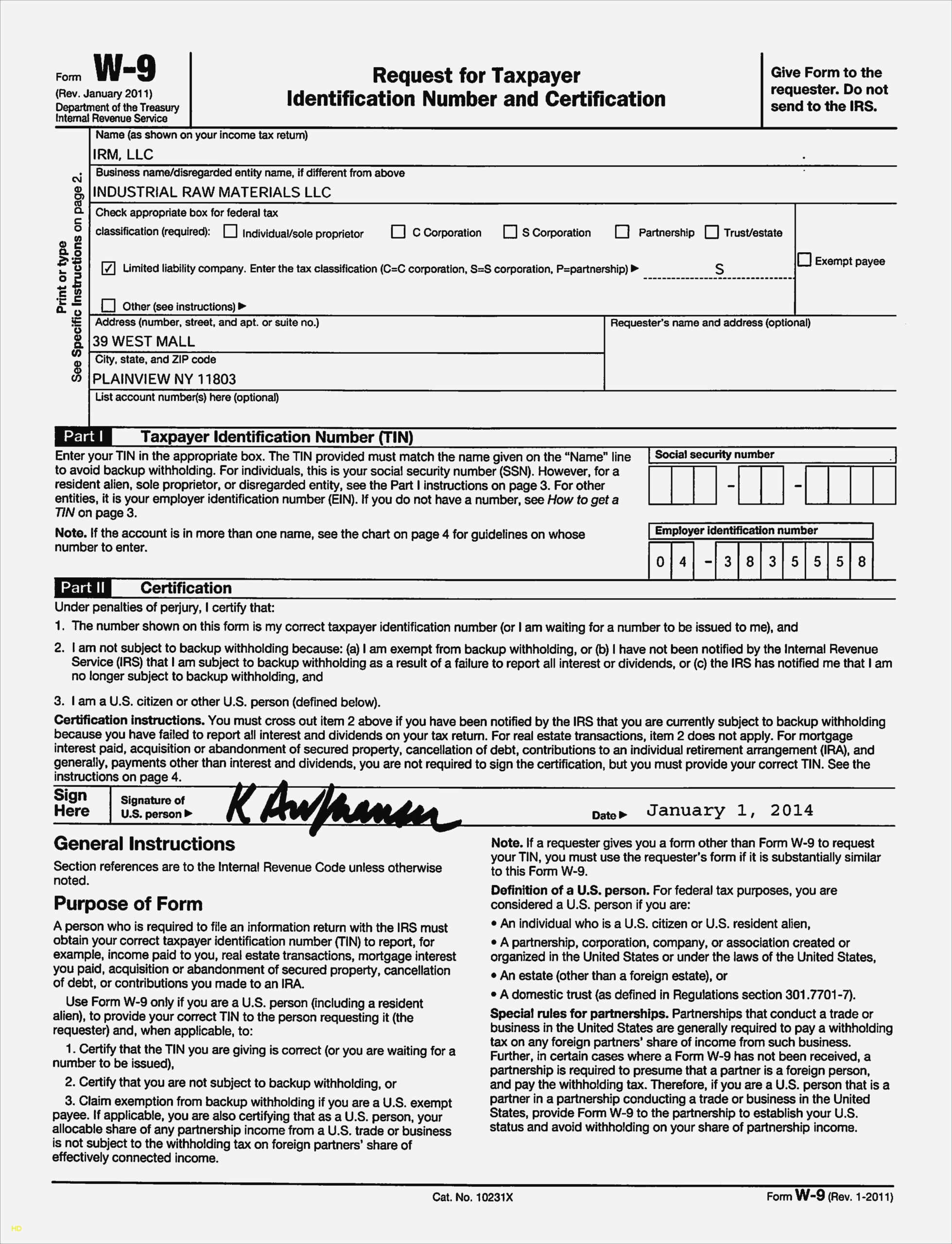

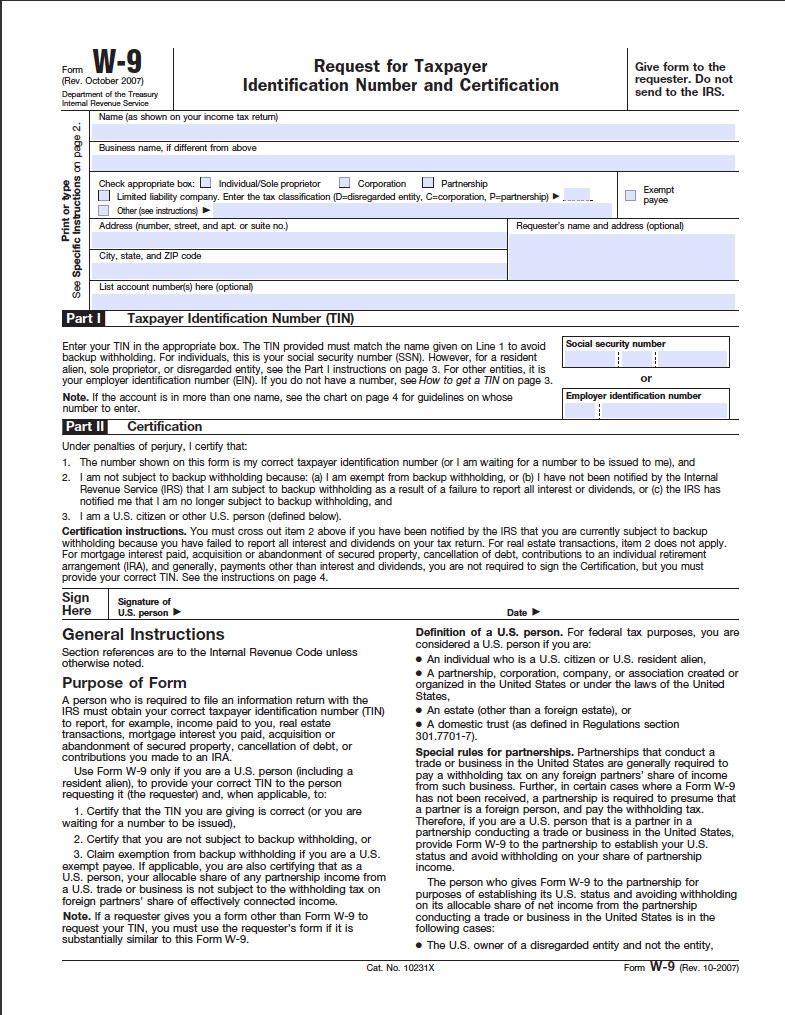

Blank W9 Form for 2021

Another printable option for the W-9 form in 2021 is a blank template that can be filled out manually. This can be useful for individuals who prefer the traditional pen-and-paper method or do not have access to a printer. The blank W-9 form can be easily downloaded and printed for filling it out by hand.

Another printable option for the W-9 form in 2021 is a blank template that can be filled out manually. This can be useful for individuals who prefer the traditional pen-and-paper method or do not have access to a printer. The blank W-9 form can be easily downloaded and printed for filling it out by hand.

2021 W9 Tax-Free Printable Form

Obtaining a tax-free printable W-9 form for the year 2021 can be beneficial for individuals seeking to reduce their tax obligations. It is important to note that any tax deductions or exemptions must be claimed accurately and within the boundaries of the law. Therefore, consulting with a tax professional or referring to official IRS guidelines is advisable to ensure compliance.

Obtaining a tax-free printable W-9 form for the year 2021 can be beneficial for individuals seeking to reduce their tax obligations. It is important to note that any tax deductions or exemptions must be claimed accurately and within the boundaries of the law. Therefore, consulting with a tax professional or referring to official IRS guidelines is advisable to ensure compliance.

W9 Form 2021 Printable PDF

PDF versions of the W-9 form for 2021 are widely available online. These downloadable files can be easily accessed and printed for completion. The advantage of using a PDF format is that it preserves the formatting and layout of the form, ensuring that it appears as intended and can be easily read by both the sender and receiver.

PDF versions of the W-9 form for 2021 are widely available online. These downloadable files can be easily accessed and printed for completion. The advantage of using a PDF format is that it preserves the formatting and layout of the form, ensuring that it appears as intended and can be easily read by both the sender and receiver.

IRS W9 Form 2021 Printable

The IRS provides its official version of the W-9 form for the year 2021, which can be printed and used for tax reporting purposes. This form ensures that individuals gather and provide all the necessary information required by the IRS accurately. It is crucial to provide truthful information as any incorrect data can lead to potential legal consequences.

The IRS provides its official version of the W-9 form for the year 2021, which can be printed and used for tax reporting purposes. This form ensures that individuals gather and provide all the necessary information required by the IRS accurately. It is crucial to provide truthful information as any incorrect data can lead to potential legal consequences.

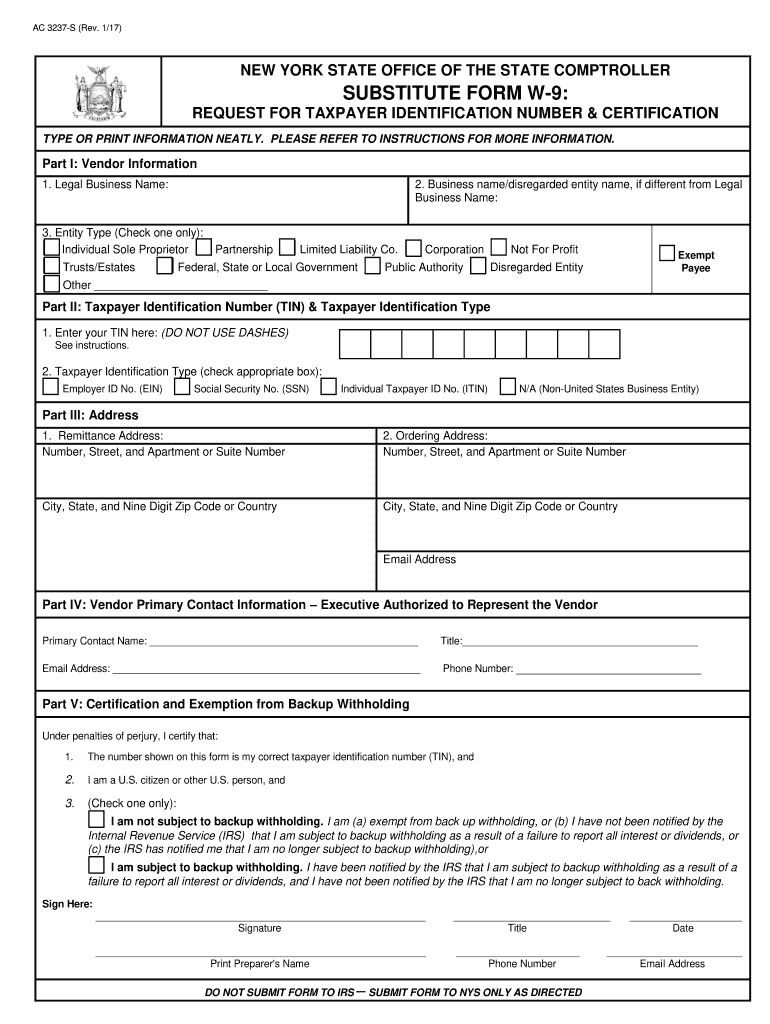

Blank W 9 Form 2020 Printable

For previous years, such as 2020, there are printable versions of the W-9 form available. These forms may have slight variations compared to the current year’s version, so it is vital to ensure the correct form is used for the relevant tax year. Using an outdated form may result in errors or delays in tax processing.

For previous years, such as 2020, there are printable versions of the W-9 form available. These forms may have slight variations compared to the current year’s version, so it is vital to ensure the correct form is used for the relevant tax year. Using an outdated form may result in errors or delays in tax processing.

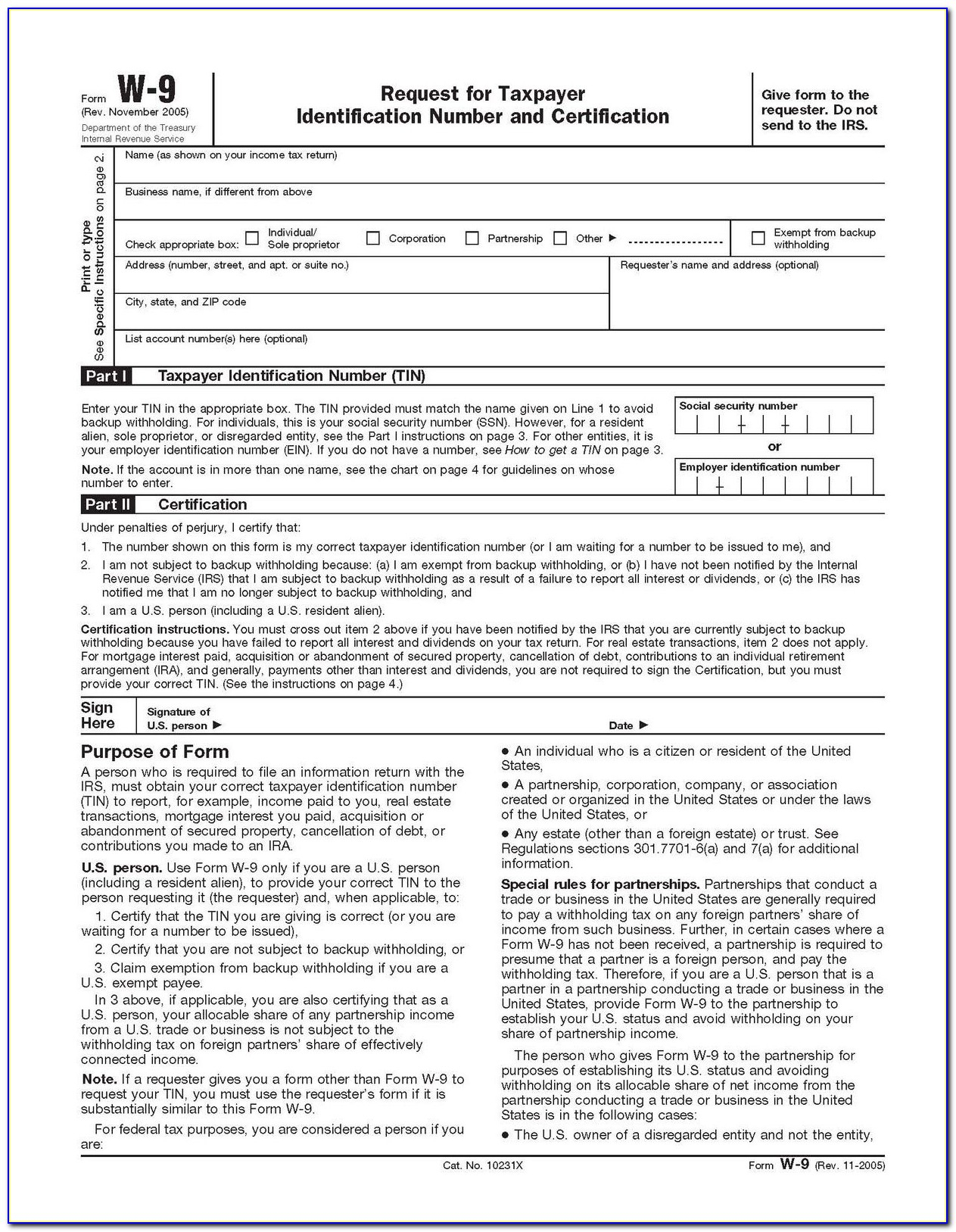

IRS W9 Printable Form 2023

Looking ahead to the future, printable W-9 forms for the year 2023 are already available. These forms are designed to stay up-to-date with any changes to tax laws or reporting requirements. It is always advisable to consult the IRS website or a tax professional to ensure the correct form is used for the specific tax year.

Looking ahead to the future, printable W-9 forms for the year 2023 are already available. These forms are designed to stay up-to-date with any changes to tax laws or reporting requirements. It is always advisable to consult the IRS website or a tax professional to ensure the correct form is used for the specific tax year.

Free Printable W9 Form 2021

Lastly, free printable W-9 forms for the year 2021 can be found online. These forms can be valuable resources for individuals or small businesses looking to save money while still gathering the necessary information required for tax reporting. However, it is crucial to ensure that the source providing the free printable form is reputable and reliable.

Lastly, free printable W-9 forms for the year 2021 can be found online. These forms can be valuable resources for individuals or small businesses looking to save money while still gathering the necessary information required for tax reporting. However, it is crucial to ensure that the source providing the free printable form is reputable and reliable.

Remember, filling out and submitting a W-9 form accurately and on time is an essential part of complying with tax laws and regulations. It is recommended to seek professional advice or refer to official IRS guidelines if you have any uncertainties regarding the form or its requirements.

Disclaimer: The data provided in this post is for informational purposes only and should not be considered as legal or financial advice. Please consult with a professional for specific guidance tailored to your individual situation.