As we navigate through the wide range of tax forms and documents, it’s essential to have a clear understanding of each one’s purpose and function. In this post, we’ll shed light on one particular form: Form 1099-NEC. This form plays a crucial role in tax reporting for countless individuals, including freelancers and independent contractors.

An Introduction to Form 1099-NEC

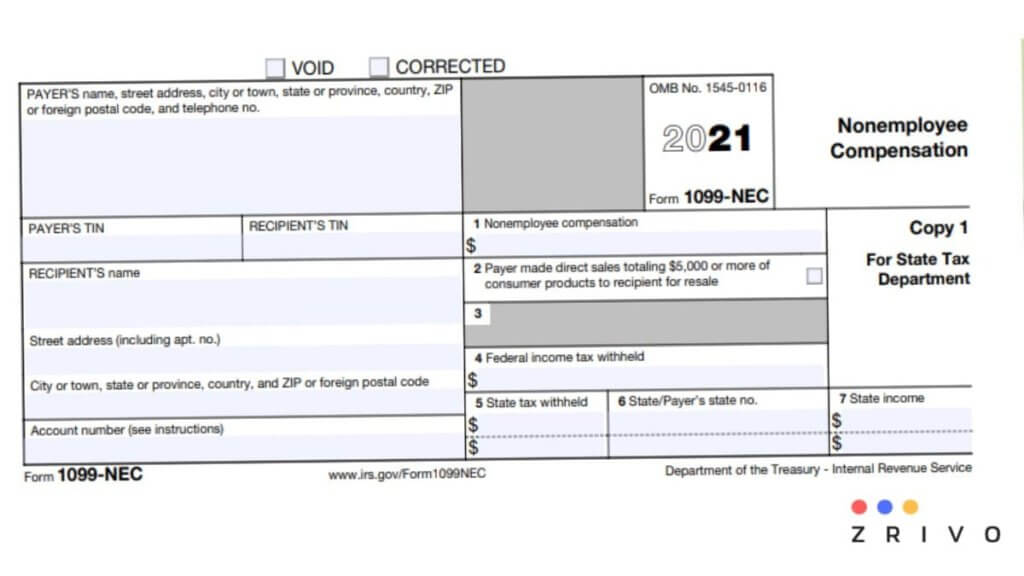

/https://specials-images.forbesimg.com/imageserve/6011f71d9357d52c817e0b2e/0x0.jpg) Let’s kick things off by understanding the basics. Form 1099-NEC is a tax form used to report non-employee compensation. It is specifically designed for businesses and individuals who pay $600 or more to freelancers, independent contractors, or self-employed individuals during a tax year.

Let’s kick things off by understanding the basics. Form 1099-NEC is a tax form used to report non-employee compensation. It is specifically designed for businesses and individuals who pay $600 or more to freelancers, independent contractors, or self-employed individuals during a tax year.

To put it simply, if you’re an independent contractor or freelancer who receives income from various sources, you may receive Form 1099-NEC from those who have paid you at least $600 throughout the year.

Understanding the Differences: 1099 vs W2

When it comes to tax documentation, another form that often comes into play is the W2 form. Understanding the differences between Form 1099-NEC and the W2 form is crucial for individuals who are subject to different tax reporting requirements.

When it comes to tax documentation, another form that often comes into play is the W2 form. Understanding the differences between Form 1099-NEC and the W2 form is crucial for individuals who are subject to different tax reporting requirements.

Form W2 is issued by employers to report wages, salaries, and tips paid to employees. On the other hand, Form 1099-NEC is used to report payments made to independent contractors, freelancers, or self-employed individuals. The distinction lies in the employer-employee relationship.

Employees classified under a W2 arrangement have specific tax withholdings, employer-provided benefits, and are subject to various employment laws. Independent contractors, as reported on Form 1099-NEC, are responsible for paying self-employment taxes, reporting their income, and handling their own benefits.

Using Form 1099-NEC: A Step-by-Step Guide

Now that we have a general understanding of Form 1099-NEC, let’s dive into the step-by-step process of using this form:

Now that we have a general understanding of Form 1099-NEC, let’s dive into the step-by-step process of using this form:

- Gather the necessary information: Before filling out Form 1099-NEC, ensure you have all the relevant details regarding the independent contractor or freelancer you’ve made payments to. This includes their name, Social Security number or Taxpayer Identification Number, and address.

- Complete Copy A: Form 1099-NEC consists of two copies, A and B. Start by completing Copy A, which will be submitted to the IRS. This section of the form requires information about your business, such as your name, address, and taxpayer identification number.

- Fill out Copy B: Now, move on to completing Copy B of Form 1099-NEC. This copy is for the recipient of the payment and should include their name, address, and identifying information.

- Distribute the forms: After you’ve completed both copies, provide Copy B to the independent contractor or freelancer. This copy serves as their record of the income they need to report on their personal tax return.

- Reporting to the IRS: The final step is to submit Copy A of Form 1099-NEC to the IRS. This can be done electronically using the IRS’s online platform or by mailing the physical copy to the designated address.

Stay Updated with Recent Changes

It’s crucial to keep abreast of any changes or updates to tax forms. For the 2021 tax year, the IRS reintroduced Form 1099-NEC, which had not been in use since the late 20th century. The reimplementation of this form aimed to separate the reporting of non-employee compensation from the more general Form 1099-MISC.

It’s crucial to keep abreast of any changes or updates to tax forms. For the 2021 tax year, the IRS reintroduced Form 1099-NEC, which had not been in use since the late 20th century. The reimplementation of this form aimed to separate the reporting of non-employee compensation from the more general Form 1099-MISC.

Therefore, if you have been using Form 1099-MISC in previous years to report non-employee compensation, it’s essential to switch to Form 1099-NEC moving forward.

Ensuring Accuracy and Compliance

Filling out tax forms can be daunting, especially when it comes to the intricacies of reporting income accurately. To ensure accuracy and compliance with IRS guidelines, here are a few essential tips:

- Double-check all information: Accuracy is key when reporting income and personal details. Make sure you have the correct information for both your business and the independent contractor or freelancer.

- Utilize online resources: The IRS website provides various resources and publications to guide you through the process of filling out Form 1099-NEC. Take advantage of these resources to ensure you’re meeting the requirements.

- Consult a tax professional: If you’re unsure about any aspect of tax reporting, it’s wise to seek advice from a qualified tax professional. They can provide personalized guidance based on your specific situation and help ensure compliance with tax laws.

A Final Word on Form 1099-NEC

Form 1099-NEC facilitates the accurate reporting of non-employee compensation, helping individuals and businesses fulfill their tax obligations. By understanding the purpose and proper usage of this form, you can navigate the complexities of tax reporting with confidence.

Form 1099-NEC facilitates the accurate reporting of non-employee compensation, helping individuals and businesses fulfill their tax obligations. By understanding the purpose and proper usage of this form, you can navigate the complexities of tax reporting with confidence.

Remember, the information provided in this post is for informational purposes only and should not be considered legal or tax advice. Always consult a qualified professional for personalized guidance tailored to your specific needs and circumstances.

Now that you have a comprehensive overview of Form 1099-NEC, you’re better equipped to fulfill your tax obligations and ensure compliance with IRS regulations. Stay diligent, keep accurate records, and navigate the tax season with confidence!